When you invest in a Systematic Investment Plan (SIP), you’re planning for long-term financial goals like retirement, children’s education, or wealth accumulation. But have you ever wondered whether the value shown in your SIP statement truly reflects your future purchasing power? Simply looking at the nominal returns may mislead you about the actual value of your money over time.

This is where understanding how to calculate the true value of your SIP investments becomes essential. By adjusting returns for inflation and real purchasing power, you get a clear, realistic picture of future wealth rather than just a number that looks big on paper.

Why Nominal SIP Returns Don’t Tell the Full Story

A typical SIP calculator tells you the future corpus based on your monthly investment, expected returns, and investment duration. However, inflation reduces the value of money year after year. For example, ₹1 lakh today won’t buy the same goods and services 20 years later due to rising prices.

So even if your investment grows, its real purchasing power might be less. This is where the concept of a true value calculation becomes critical for smart investors.

What Is Real Value in SIP Investing?

The real value of your SIP investment refers to how much your future corpus is worth in today’s money after accounting for inflation. This gives you a more accurate idea of what your savings can actually buy when you need them most.

Step-by-Step: Calculating True Future Value

Here’s how you can estimate the real worth of your SIP portfolio:

1. Gather the Key Inputs

To begin, you need the following:

-

Monthly SIP amount

-

Expected annual return rate (e.g., 10–12%)

-

Investment duration in years

-

Estimated inflation rate (commonly 5–7% in India)

2. Use an Inflation-Aware Tool

While you can do the math manually, the easiest way is to use an online Inflation Adjusted SIP Calculator, such as available on Pocketful. This tool automatically adjusts your returns for inflation and shows both nominal and real values.

3. Interpret the Results

A good calculator will show:

-

Total amount accumulated (nominal value)

-

Real value adjusted for inflation

-

Purchasing power in today’s terms

This comparison helps you see how inflation can affect your long-term goals and what you should realistically expect.

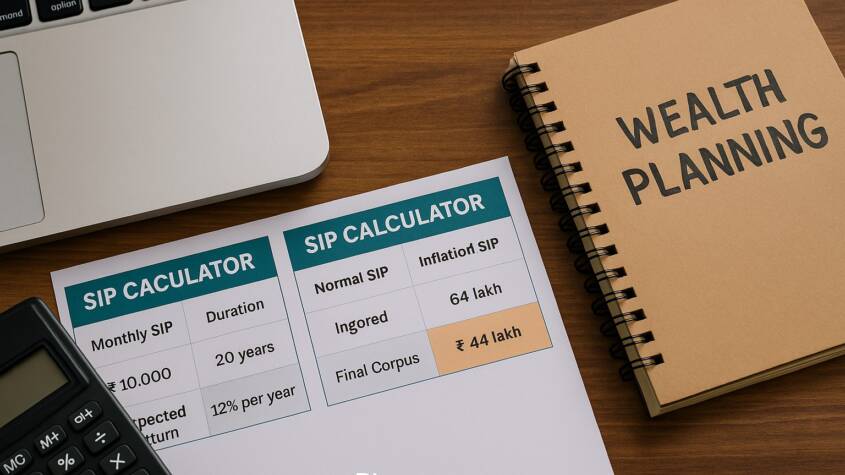

Example Illustration

Let’s say you invest ₹10,000 per month in a SIP for 20 years with an annual return of 12%, and inflation averages 6%. A standard SIP calculator might show a large corpus based on compounding alone. But after adjusting for inflation, the real value (today’s purchasing power) will be significantly lower — often almost half of the nominal amount.

Why This Calculation Matters for Financial Planning

Calculating the true value of your SIP investments helps you:

Set Realistic Goals

Knowing how inflation impacts returns ensures you don’t overestimate your future wealth.

Adjust SIP Amounts

You might need higher contributions to meet your true financial needs after accounting for rising costs.

Compare Funds Better

Inflation-adjusted returns allow you to evaluate which mutual funds perform best in real terms.

Pocketful’s Calculator: A Practical Tool for Investors

Pocketful’s Inflation Adjusted SIP Calculator lets you:

-

Enter your monthly investment

-

Add expected returns and investment period

-

Include an inflation rate

-

Instantly see the future value in real purchasing power

By using such tools, you can plan smarter and more confidently, aligning your investment strategy with real-world financial needs.

Conclusion: Don’t Just Look at the Numbers — Understand Their Value

A high corpus figure may seem exciting, but its true worth depends on inflation-adjusted purchasing power. By calculating the real value of your SIP investments, you ensure that your long-term financial planning is based on reality, not just optimistic projections.

In essence, understanding your SIP in inflation-adjusted terms empowers you to make better investment decisions and stay on track toward your financial goals — without surprises.

Read Also this Blog: ETF vs Mutual Fund Calculator: Simple Guide

Freight Forwarding Services in Canada: How Progressive Cargo Simplifies Global Logistics

Freight forwarding plays a crucial role in today’s interconnected global economy. Business…